Interest is a bitch.*

The amount of money financed on car loans, student loans, personal loans, and credit card debt is enormous (we’re talking trillions, with a T). And the interest paid on it is staggering.

And in large part, unnecessary. But that’s a subject for another post. Or several other posts. For now, let’s talk about systematically attacking your debts.

Since you’ve definitely done your budget now, and you’ll be cutting out that excess spending, you know how much additional money you can put towards your debt than you have been paying. The more you can squeeze out of your budget, the faster the debt will come down, and the less interest you will be paying, which saves you money in the long run.

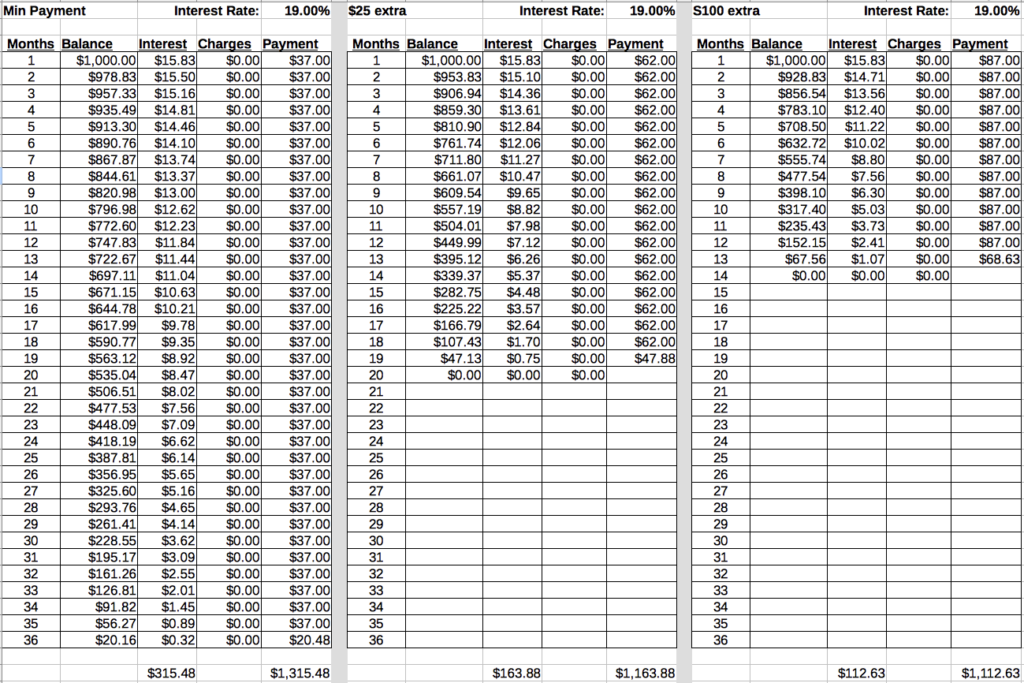

In this example, I have used a credit card with $1000 balance and 19% interest rate, and 3 different monthly payments, $37, $62 and $78.

Paying $37 a month, it takes 3 years to pay off the card. But you can see that paying only an extra $25 a month shaves 17 months off the time to pay the card off and saves $151.60 in interest. An extra $50 a month shaves 23 months and saves $202.85 in interest. Isn’t that worth making coffee at home or bringing lunch from home on Fridays? The higher the interest rate, the more you save by paying it off as fast as possible, so it’s worth putting as much towards your debts as you can manage.

Scott here, I would like to take a moment to talk to you about a service we love and use called You Need A Budget.

We tried a lot of different personal finance software options and none of them seemed to do what we needed. You Need A Budget really allows you to see where your money is going and most importantly it helps you develop and stick to a budget. They offer a 34 day trial so you can take your time and see if you really like it before paying.

Click here to try it out for free!

If you have more than 1 interest accruing debt, you’ll need to start paying the minimum on all but 1 of the debts, and applying all your extra monthly income to just 1 debt. When that debt is paid in full, you then roll what you were paying on that debt into what you are paying on the next debt. And so on until you’ve paid all your debts off.

For example, say your minimum payments on 3 credit cards are $25, $35 and $40. In addition to these minimum payments, you have another $75 to put towards paying down the balances. You’ll apply that $75 to 1 card, let’s say the $40 minimum payment, for a total of $115 a month going towards that card. When that card balance is $0, you’ll apply the $115 to the $35 minimum payment card, for a total of $150 a month, until that ones at $0 as well. And then that $150 gets added to the $25 payment on the last card.

But which debt do you start with? There is a famous author and radio show host who advises people on how to get out of debt who will tell you to pay off your smallest balance first. It’s not because it costs you the least amount of money. It’s because it will motivate you to continue paying off your debt. If you think you’ll need that motivation, then follow his advice. Otherwise, start with the debt with the highest interest rate. It will save you the most money in the long run.

We’ve attached a spreadsheet that you can use to track and project your payoff times. There is room on it for 3 credit cards and/or loans, but you can copy the formulas over if you have more debts than that. You can mess around with the amounts paid on them and see how much faster adding a few more dollars to your payments will pay off your debts.

Happy spreadsheeting!

Kat

*At least when it’s on debt you owe. When it’s on money you’ve saved or invested, it’s quite delightful.